The Market Dispatch, March 06, 2024

Last year, the prevailing narrative for global monetary policy was “higher for longer”. That came to an abrupt end in mid-December, after the Fed’s policy meeting which signaled that it was time to think about cutting rates. This made perfect sense since the Fed last hiked rates in July 2023. Thus, the market adopted a new narrative, “cuts, cuts, cuts”.

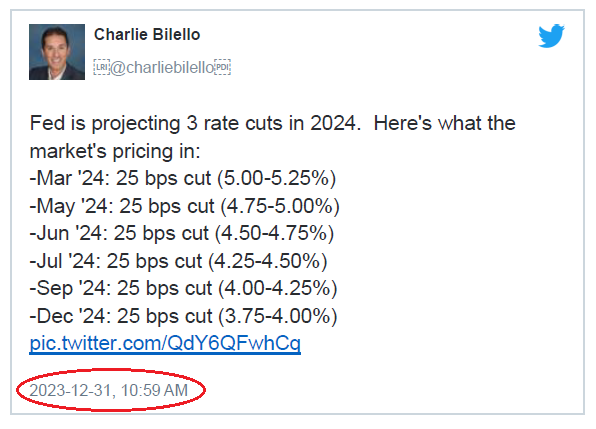

The market ran with this new narrative and proceeded to price in about 6 quarter point rate cuts for 2024 (see the tweet below from the last day of 2023). This is more than double the cuts that the Fed’s dot plots had forecasted for the year. Thus, Fed members began the process of walking back the market’s perception at every speaking opportunity on their schedule. This, along with the help of strong economic data caused the market to converge with the Fed’s view for 3 rate cuts. The market has now pushed back the Fed’s first rate cut from March to July.

Of course, the convergence from the market’s view to the Fed’s view also applies to other key global central banks. The bottom line is that the first rate cut will come later this year and the amount of cuts will be less than thought likely at the end of last year.

- European Central Bank: -Before 161 bps – Now 95 bps

- Bank of England: – Before 161 bps – Now 65 bps

- Bank of Canada: – Before 161 bps – Now 75 bps

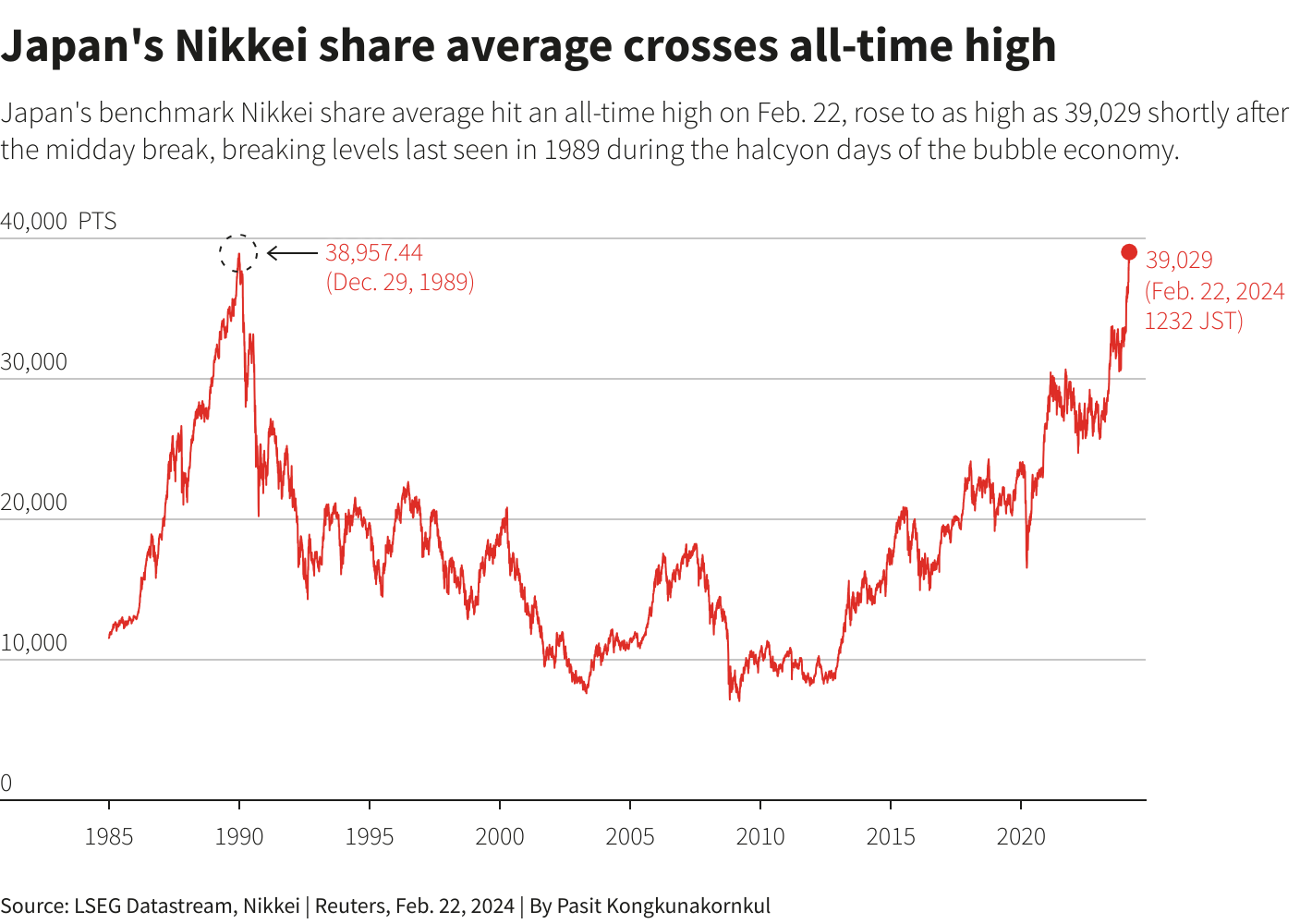

As for the Bank of Japan, that is a whole other kettle of fish. While most central banks like to say they are data dependent, the Bank of Japan seems less so. Japan’s core inflation, which the BOJ targets at 2%, is poised to fall below that this month. Furthermore, their economy has contracted for the past two quarters, and there is a real risk it is continuing to shrink in Q1. Remember, the BOJ is still in a negative rate environment so instead of moving to a neutral policy stance they want to raise interest rates. I guess they view the negative interest rate policy as having reached a point where the costs outweigh the benefits. Thus, it is more of a policy decision than a economic one. Comments last week by BOJ Governor Ueda at the G20 finance ministers meeting suggested a move in March.

Before we leave the topic of Japan, last week the Nikkei 225, Japan’s main stock index, moved 2.1% higher, breaking through its previous high reached on Dec. 29, 1989. That’s not a typo, yes it took Japanese investors 34 years to regain what they lost. Keep in mind they had a little help from the BOJ which pursed a negative interest rate policy along with QE since 2001.

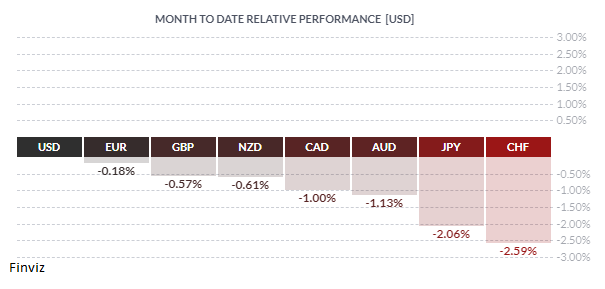

On the currency front now that the market expectations have converged with the Fed’s view from the end of last year. This interest rate adjustment has also helped the USD recover from its November – December drubbing. With that said, now that the adjustment appears to be over, the USD may be ready to top and gently move down again.

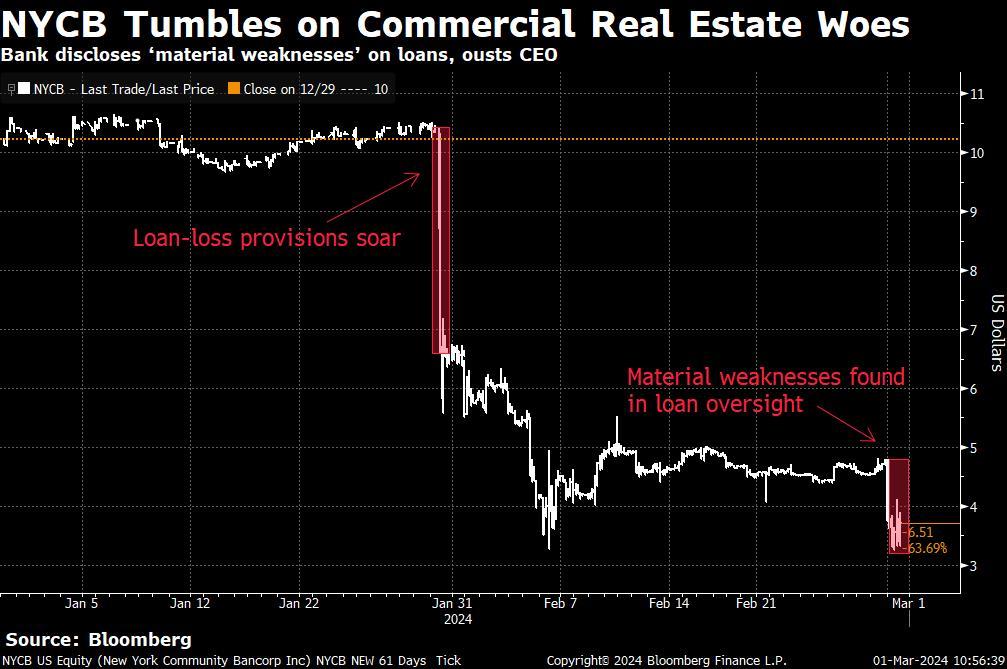

I can only see two events that could change the Fed’s path. The first one is sticky inflation. If inflation would remain stubbornly high or begin to move up again then the Fed would be forced to change tact. The other event would be a further deterioration in the financial health of the community and regional banks due to their significant exposure to commercial real estate. The Fed may be forced to pull out a new funding mechanism to address this issue.

Coincidently, Fed Governor Christopher Waller hinted last Friday that he would like to see two key developments in the Fed’s portfolio. First, I would like to see the Fed’s agency MBS holdings go to zero. Second, I would like to see a shift in Treasury holdings toward a larger share of shorter-dated Treasury securities. Translation, he was hinting at an ‘Operation Reverse-Twist’ which will lower short-term yields and steepen the yield curve. Policy makers love to come up with this fancy terms that disguises what they are actually doing which is this case would be another round of QE, i.e. just another form of monetary debasement. And as I point out in the January dispatch, the only way to fight that is with hard assets like commodities, gold, and bitcoin.