The Market Dispatch -July 3, 2024

Over the last month, I can’t help but think of the 90’s Seinfeld episode, “The Bizarro Jerry”. It was based on the 60’s DC Comic Bizarro World in which society is ruled by the Bizarro Code which states “Us do opposite of all Earthly things”. Specifically, I was thinking about the economy and politics.

At the beginning of 2024, US economic data was cooking, the economy was firing on all cylinders. Yet, everyone was screaming from the rooftops for the Federal Reserve to cut interest rates. In fact, the markets were pricing in 6 to 7 quarter point rate cuts for this year. Fast forward to now, and the economy is normalizing and/or weakening, and the pundits are screaming for no to 1 or 2 rate cuts for 2024. See what I mean about Bizarro, it’s the complete opposite ¯\_(ツ)_/¯.

The same is true for politics. If you tune into the media, all you will hear about is the threat of the “far-right” getting a foothold in Europe. The political right did make some headway in the recent European Parliament Elections which caused President Marcon of France to throw down the gauntlet and call a snape election. By all accounts, phase one of the election is happening this weekend, and the political right, lead by Marine Le Pen, is projected to come in first while Marcon’s party is seen slumping to third.

An aside, it really rubs me the wrong way when the media portray a political party as “far-right”, it is disingenuous. As long as I can remember, political parties in a democracy were either left, center, or right, end of story. I actually don’t even think in these terms when it comes to politics because to me, they are both sides of the same coin. The way I see it when a country votes for the other side of the political spectrum, it is because they are tired of the current leader and want a change. I believe, that in most cases, the political party could remain in power if the unpopular leader would step aside and let someone else within the party take the reins.

Ok, enough of my rant, let’s get back to European politics. If Le Pen does manage to unseat Marcon, is it not Bizarro, that across the English Channel, the UK is about to unseat the right and install the left-wing party, Labour Party. it’s the complete opposite ¯\_(ツ)_/¯, again.

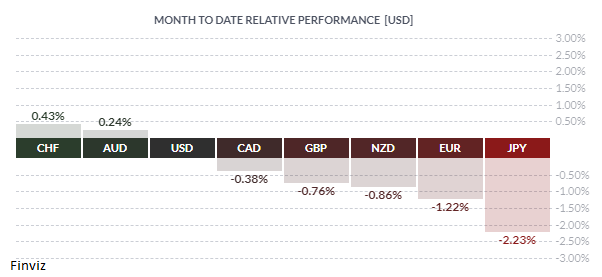

By the way, there was some Bizarro action in the currency markets as well. Isn’t it interesting that the Swiss franc was the best performing currency in June even though the central bank surprised the markets by cutting rates for the second consecutive meeting this year in response to falling inflation while signalling it is ready to intervene in currency markets to stem gains in the franc.

Meanwhile, the yen can’t seam to help itself. The Japanese central bank has raised rates once, but the currency keeps dropping. The market drove the USD up above 161 in a relentless trend that saw the yen depreciate in 12 out of 15 sessions, including a stretch of seven consecutive losses. The yen’s string of losses was due to the Bank of Japan’s decision to postpone a potential reduction in bond purchases until its July meeting, which would mark the beginning of quantitative tightening, wherein new bond purchases fail to fully cover maturing issues. Having said this, the BOJ is expected to increase its overnight target rate by the end of the month and to scale back its bond purchases.

Click on Images to enlarge

Month to Date Relative Performance (USD)

USD/CHF

USD/JPY

USD

All eyes remain on the Fed and the USD. The USD has peaked but it remains stubbornly high as can be seen by the price action in the US dollar index, a proxy for global trade.

The USD will eventually rollover, but it will not start until the Fed cuts rates or gives a clear signal that it is about to cut. As it stands now, that doesn’t seem to be in the cards, especially when you hear the most dovish Fed member, San Francisco Fed President Mary Daly, say the following:

- Recent inflation readings more encouraging but hard to know if on track to price stability

- We have made a lot of progress on inflation, still work to do

- Nearer to a point where benign outcome on labor market could be less likely

- Must fully restore price stability without a painful disruption to the labor market

- If inflation falls more slowly than expected, policy rate must stay higher for longer

- If there are gradual declines in inflation, slow labor market rebalancing then the Fed an normalize over time

- At this point, we have a good labor market not a frothy one The wait continues…