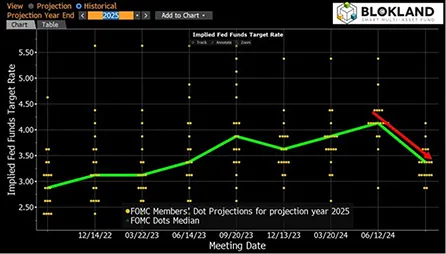

The long-anticipated move has finally happened— the Federal Reserve kicked off the monetary easing cycle with a larger-than-expected 50 basis point rate cut, instead of the predicted 25 bps. But that’s just the beginning. The updated Dot Plot now projects eight more rate cuts by the end of 2025, up from the five expected in June, marking a significant downward revision that aligns more closely with market expectations.

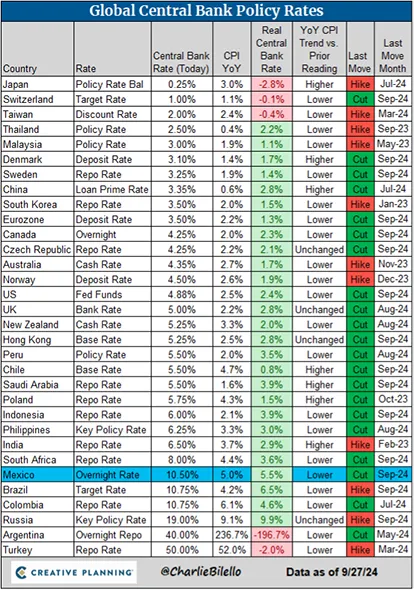

With this move, the Fed becomes the seventh G10 central bank to cut rates this year. In fact, September alone saw 12 other central banks reduce rates. What’s more, this global monetary easing phase is just getting started, and the pace of cuts could accelerate. Sweden and Canada, for example, both cut rates by 25 bps in September, with signals suggesting they may quicken the pace going forward.

The liquidity environment has more surprises in store. China, after a prolonged wait, finally rolled out a series of measures to support its stagnant economy, which has been weighed down by the ongoing deleveraging of its domestic real estate market. Their delay was due to concerns over currency weakening, which could exacerbate economic issues. But after the Fed’s move, China followed suit by opening the liquidity taps. The announced stimulus package includes:

- A 20 basis point cut to the seven-day reverse repo rate, bringing it to 1.5%.

- A 50 bps cut to the reserve requirement ratio.

- $113 billion in liquidity support for stock market participants, with the potential for more.

- Increased coverage for local government loans to purchase unsold homes, now covering 100% of the principal, up from 60%.

- Upcoming 50 bps cuts to existing mortgage rates.

- Lowering the minimum down payment for second-home buyers from 25% to 15%.

On the flip side, 11 central banks have yet to cut rates, though Australia and Norway are likely to join in next year. Japan, however, is going in the opposite direction, gradually normalizing its monetary policy through quantitative tightening. The Bank of Japan (BOJ) has already begun reducing its balance sheet by not reinvesting maturing proceeds and has signaled intentions to raise rates further, as long as economic conditions and prices evolve as expected. The BOJ has two more meetings this year (October 31 and December 19), though the market now expects the next rate hike to occur next year.

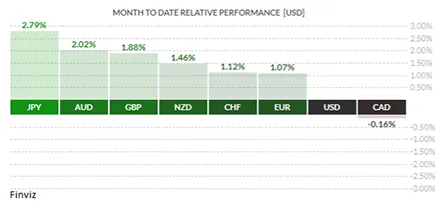

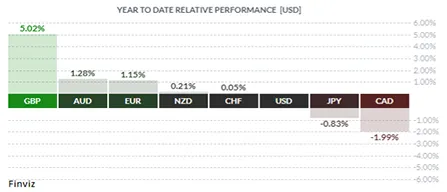

Looking at currency performance year-to-date, the GBP is the strongest, up 5.2% against the USD. This is in part due to the Bank of England maintaining the highest policy rate in the G10, with only one rate cut this year. Markets expect another cut in November.

On the weaker end, the CAD has declined by 1.99% so far in 2024, largely due to the Bank of Canada’s dovish stance. After three consecutive 25 bps rate cuts, the Bank of Canada appears ready to pick up the pace, with markets pricing in 75 bps of cuts across the final two meetings of the year (October 28 and December 11).

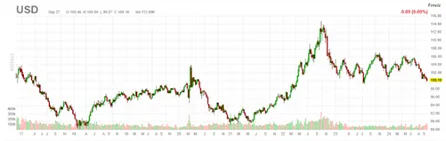

The weekly U.S. dollar index chart reveals a consistent decline since May. With the Fed now easing policy, the index could fall to its 2021 lows. It’s important to note that this currency movement doesn’t reflect stronger foreign economies but rather the broad-based weakening of the U.S. dollar, driven by the Fed’s shift toward looser monetary policy.