It’s time for a shift in the narrative. Back in August, the focus was on the unwinding of the Japanese yen carry-trade. After that, attention turned to China’s stimulus efforts to combat issues in its real estate and stock markets. Then, the spotlight was on the Federal Reserve’s first rate cut in its easing cycle. That narrative quickly gave way to the U.S. election, dominating market attention. Now, with election day approaching and hopes for a decisive outcome, the market’s attention is set to shift yet again—to the incoming president’s vision for the country.

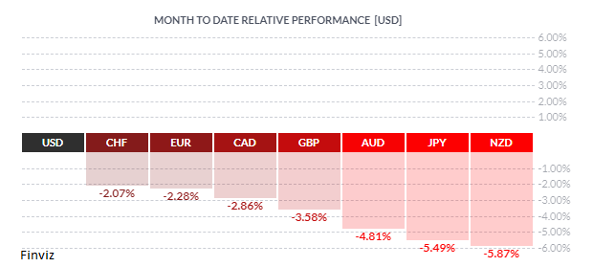

As we see from the monthly relative strength chart, the USD had a strong October, marking its biggest monthly gain since April 2022. This surge was fueled by robust economic data and the prospect of Donald Trump’s reelection, which could keep interest rates elevated for an extended period. Recent economic indicators show an economy that remains resilient. The market is factoring in a potential Trump win, which implies a continuation of policies that favor growth and, consequently, support the dollar. However, the race remains close, and a Trump victory isn’t guaranteed; I’m simply noting the market sentiment.

Why would a Trump win drive the USD higher? It’s straightforward: if Trump implements trade tariffs and tax cuts, inflationary pressures would likely increase, reducing the Fed’s likelihood of cutting rates soon. This is ironic, given that Trump’s team has voiced a preference for a softer USD.

If Harris wins the election, it doesn’t necessarily spell trouble for the USD either. Some of October’s gains might be given back, but underlying economic data, central bank policy, and a favorable economic backdrop continue to support the dollar. Any USD sell-off could become a buy-the-dip opportunity.

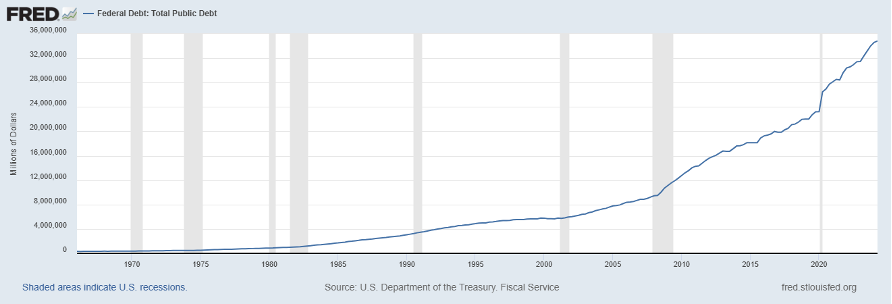

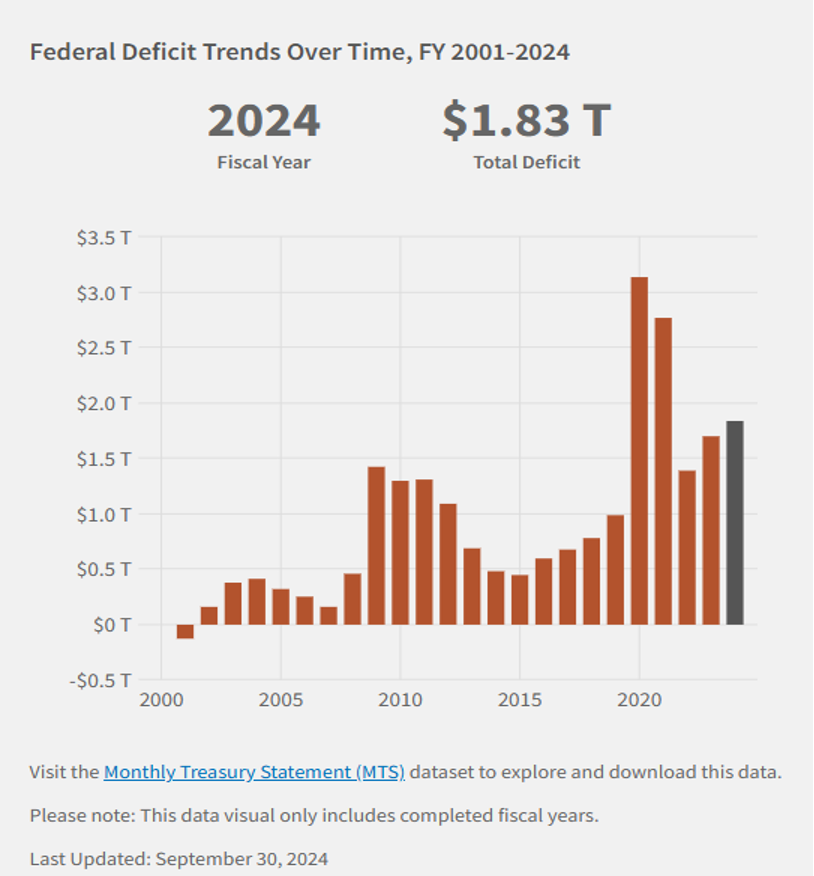

Neither candidate has presented a clear plan to address the widening budget deficit or national debt. Higher fiscal deficits are pushing Treasury yields upward, making the USD more attractive. Rising Treasury yields are also pulling foreign yields higher despite weaker economic conditions abroad. This dynamic is tightening financial conditions globally, potentially leading other central banks to cut rates further, which, ironically, strengthens the USD. It’s a peculiar reflection of America’s unique position in the global economy: as the fiscal outlook worsens, the USD paradoxically gains strength.

So deficits don’t matter until they do. This self-sustaining scenario can only last as long as global investors remain willing to fund U.S. deficits in exchange for modest yields. The UK experienced a similar situation briefly in 2022. No one knows when it might happen in the U.S.

Finally, it’s worth noting that Moody’s remains the only one of the three major credit agencies that hasn’t yet downgraded U.S. credit. S&P lowered the U.S. credit rating in 2011 during the debt ceiling crisis, and Fitch followed suit after the 2023 debt ceiling debate. In September, following the passage of a short-term budget extension, Moody’s hinted at a potential downgrade after the election, underscoring the impact of rising fiscal uncertainty.