At the start of 2024, market consensus widely predicted that the U.S. Federal Reserve would slash interest rates six times, with speculation rising to as many as seven cuts by mid-January. A recession, deemed imminent, was expected to drive this aggressive monetary easing. However, as 2025 begins, those forecasts appear vastly overstated. Inflation has proven more persistent than anticipated, and now the debate centers on whether the Fed might manage even two rate cuts this year. How quickly perspectives can shift.

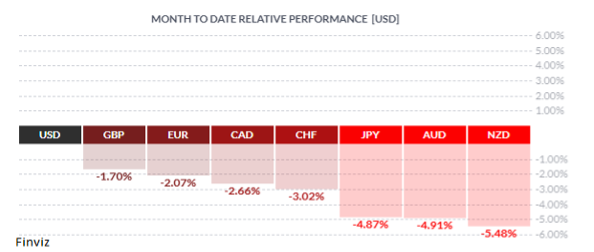

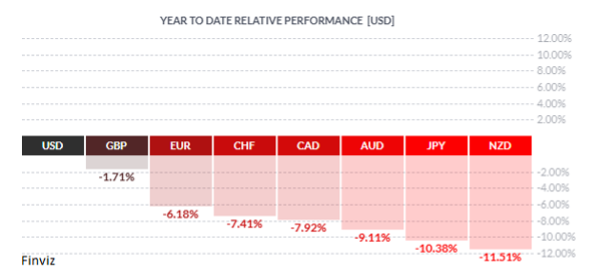

Canada, too, is grappling with political instability, with an election looming. The Bank of Canada has been the most aggressive in slashing rates, delivering two 50-bps cuts and totaling 175 bps of reductions in 2024. Markets are pricing in three more 25-bps cuts for 2025, further widening the interest rate gap with the U.S. and exerting pressure on the Canadian dollar (CAD).

In Asia, Japan is expected to hike rates once in 2025 after exiting negative rates in 2024 with two increases. In contrast, China faces significant economic challenges. Disinflation and deflation persist despite lower interest rates and supportive policies. Complicating matters further is the potential for a trade and tariff war with the Trump administration, which could undermine China’s already fragile growth.

Every country is grappling with rising debt, and many might benefit from weaker currencies to monetize it. But with all nations facing similar pressures, a coordinated approach may be the solution. Central banks could agree to devalue their currencies collectively against a common asset—gold—boosting the asset side of their balance sheets and reducing debt-to-asset ratios. Such an agreement, akin to the Bretton Woods or Plaza Accord, might come to be known as the “Mar-a-Lago Accord,” in honor of its hypothetical birthplace.

While such a scenario is speculative, it underscores the interconnectedness of global monetary policy and the challenges of navigating an uncertain economic landscape.

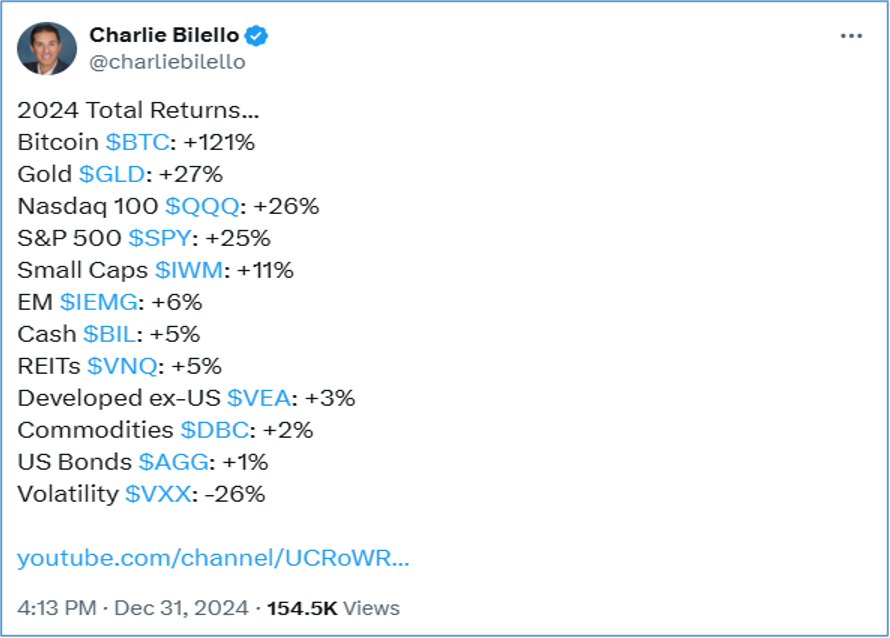

Before I let you go, I was curious about what I wrote in last year’s January Dispatch – here is the last paragraph : When you add in the ongoing geopolitical concerns Ukraine War, Middle East, and China Tiawan, I suspect the best currency to be exposed to is not a fiat country currency but rather the “fiat alternatives” or “store of value” plays of bitcoin and gold. I’m officially patting myself on the back, because bitcoin and gold were the two best performing assets of 2024.