The opening words of last month’s letter couldn’t have been more fitting: “There’s no turning back now, and the rest of the world knows it.”

The events that followed proved just how true that was.

On April 2nd, “Liberation Day,” the reciprocal tariffs announcement felt less like true reciprocity and far more like raw protectionism. Instead of a measured response, tariffs were set at a weighted average of 24%, with expectations climbing toward 27% once Section 232 (national security tariffs on steel and aluminum) were factored in.

Markets were stunned. Volatility spiked. High-yield credit spreads widened. Bond yields rose. Equities sold off hard. The USD weakened. Typically, a stock market drop would see bond yields fall, and the USD rise as investors flock to U.S. Treasuries. Not this time. Days later, I shared this in Ascendant’s trader chat:

“For over 30 years, I’ve dismissed claims that the USD would collapse or lose reserve status, pointing to the unmatched depth of the U.S. bond market. After the past two weeks, I’m rethinking that stance.”

These events align strikingly with *The Fourth Turning* (1996) by William Strauss and Neil Howe, which argues that history follows predictable 80-100-year cycles split into four phases. The Fourth Turning, a crisis period, brings upheaval, institutional collapse, and the birth of a new order. Think American Revolution (1770s), Civil War (1860s), or Great Depression and WWII (1930s-40s). Howe claims we’ve been in a Fourth Turning since the 2008 financial crisis. Old systems crumble; new economic, political, and cultural structures emerge; leadership and global power realign.

President Trump fits this mold, accelerating the demise of the old order while shaping a “New World Order.” His rhetoric—rejecting globalism, championing national sovereignty—targets post-WWII frameworks like NATO, the UN, WTO, and multilateral trade deals. His push for economic self-reliance and nationalism disrupts norms, challenges alliances, and forces institutions to adapt or fail. In a Fourth Turning, disruptive figures like Trump don’t restore the past; they clear the path for what’s next. His vision prioritizes national identity over globalism, bilateral deals over global pacts, economic protectionism, and a weakened bureaucratic state.

Whether you support or oppose Trump, the Fourth Turning lens sees him as a historical force—a “gray champion,” an older leader who emerges in crisis to steer the outcome. “Liberation Day” wasn’t a resolution but a catalyst for uncertainty. Tariffs pose the greatest market risk, not just through immediate impacts but via second-order effects that could tip the U.S. into recession absent significant progress.

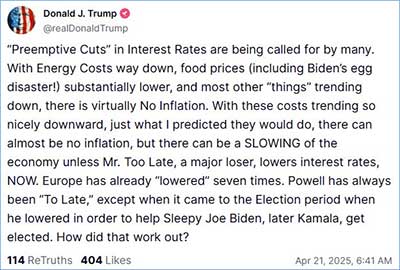

Compounding this, Trump’s public attacks on Federal Reserve Chair Jerome Powell for resisting rate cuts threaten the Fed’s independence. A politically controlled central bank risks currency credibility—look at Turkey’s lira. Yet, Powell’s 50 basis-point cut in September 2024, with stocks at record highs and GDP near 3%, suggests political motives, possibly to bolster Democratic election chances. Firing him would be justified but disastrous for the Fed’s reputation and the USD. The Fed’s silence during the tariff-induced market turmoil—no statement on monitoring liquidity or supporting markets—underscores the strained White House-Fed relationship. Reports of the administration exploring ways to oust or marginalize Powell have so far been shrugged off by markets. But an actual firing or a “shadow” Fed chair could unleash chaos.

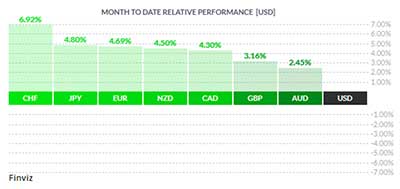

Currency markets reflect deeper unease. The USD is weakening sharply: USD/CHF at a 10-year low, EUR/USD at its highest since 2021, GBP/USD at its strongest since October, USD/JPY and USD/CAD at multi-month lows, the DXY at its weakest since 2021, and gold hitting all-time highs. This feels like the early stages of a bank run on the USD, with Wall Street—domestic and global investors alike—rushing for the exits. An 18-year chart of the All-World ex-US ETF versus the S&P 500 shows capital is starting to flee U.S. markets.

Is this a permanent shift or a temporary blip from “Liberation Day” chaos? I lean toward a lasting regime change, akin to the USD’s weakness from 2001-2008 or the flight to U.S. assets from 2012-2022. Even if Trump’s administration reverses course on tariffs, the damage is done. Trust has been broken — and broken trust doesn’t mend easily.