The Market Dispatch May 1, 2024

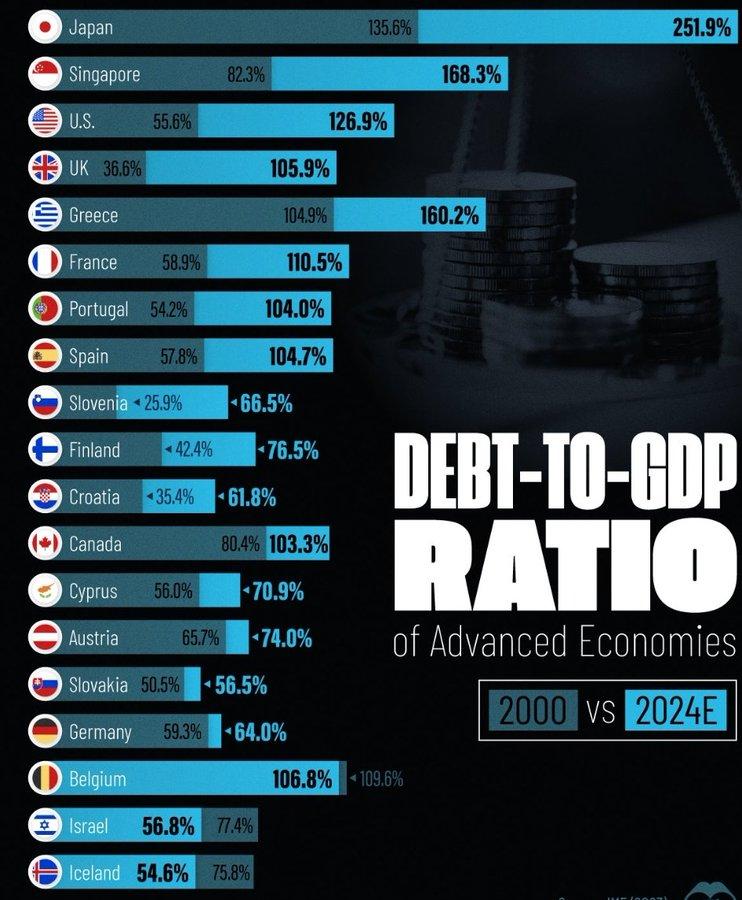

The US has endured the fastest increase in interest rates, from zero to 5.5% yet inflation remains sticky and threatens to reaccelerate. Why is that? The answer is fiscal dominance. The government is spending at a higher rate than the economy is growing. Fiscal dominance refers to the possibility that the accumulation of government debt and continuing government deficits can produce increases in inflation that “dominate” central bank intentions to keep inflation low. With the government adding about $1 trillion in debt every 100 days, it’s hard to see how the Federal Reserve can stay the course to tame inflation properly.

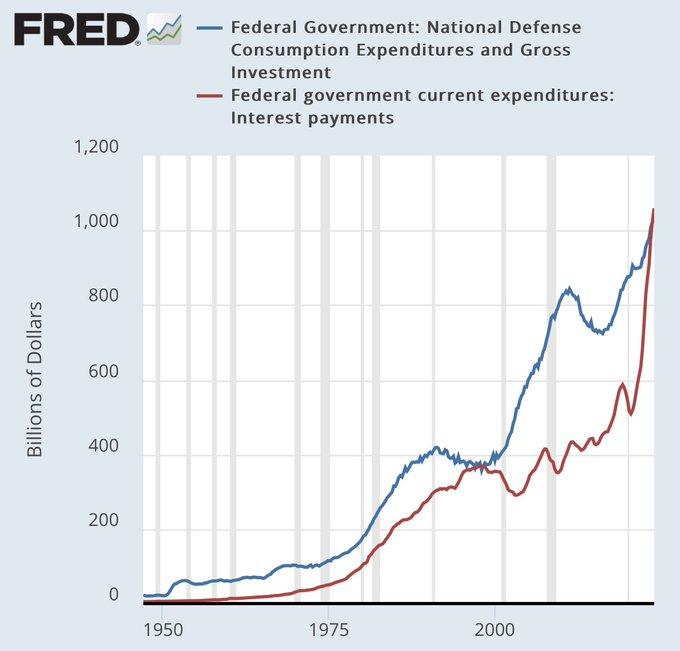

There’s never been this much spending outside of an economic downturn. Usually, the government turns on the spending to help the country out of recession, but this level of spending is uncalled for. The combination of higher fiscal spending and higher interest rates has caused the annual interest expense to exceed $1 trillion for the first time in history, exceeding spending on national defense.

This obviously makes the Fed’s job a lot harder. The recent uptick in inflation would, under normal circumstances, cause the Fed to hike, but Fed hikes are not a thing, they are an impossibility. Ultimately, the Fed faces a political choice between hiking rates until inflation comes down, causing a recession, and tolerating high inflation. If the Fed were to hike, then President Biden’s chances of winning the election would diminish. The best the Fed can do is jawbone – threaten to hike but not actually hiking. Furthermore, if the Fed wants to give the President a fighting chance they need to cut rates at least two times before the election.

Powell may also have other things on his mind as well, like his job. According to an article in the Telegraph, Trump plans on setting interest rates himself and to oust Chair Powel.

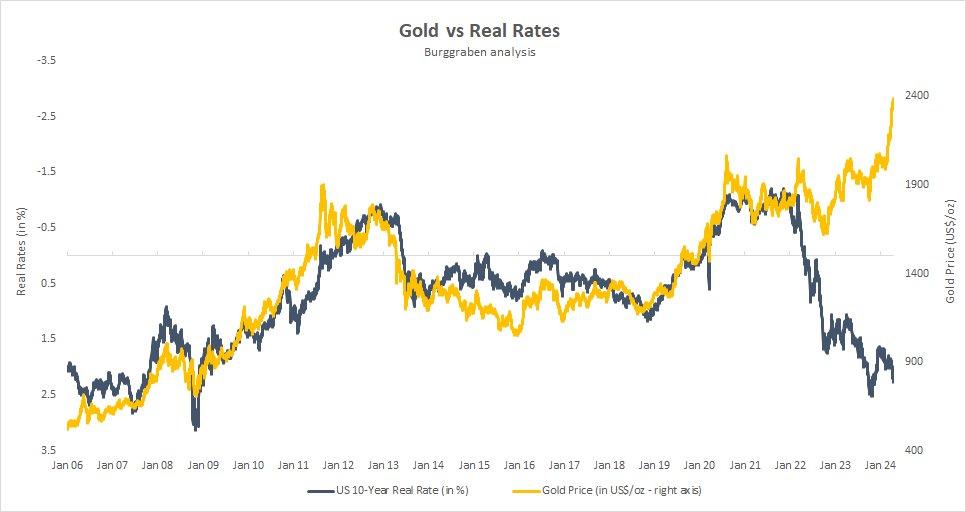

Let me remind you that gold has already sniffed this out. It has accelerated its advance ever since the Fed pivot.

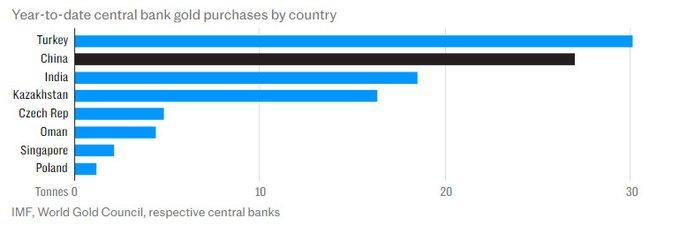

And who has been constantly buying the gold – foreign central banks, of course. They know what is happening and they are hedging against the future debasement of the USD. Here is an interesting tidbit. Canada recently reported its monthly surpluses in January and February, but what was most notable is that more than half of February’s 5.8% jump in merchandise exports was accounted for by unwrought gold shipments to Switzerland and the UK. There was also an increase in high-value shipments of refined gold and transfer of gold assets in the banking sector. Excluding the unwrought gold, Canada’s exports would have risen by only 2.8%. The increase in demand is real.

Understanding the gold market used to be straightforward – you only had to have a view on the direction of US real rates. Gold traded inversely to real rates for decades – lower or negative real rates meant you needed to buy gold and vice versa. This is because gold does not offer a yield (like US bonds offer coupons), but it does offer more safety than an “I owe you” from a US government bond. Gold was and remains the safety trade in times of lower or negative US real rates. So that was the gold trade.

The gold trade changed with the 2022 US sanctions on US Treasuries held by the Bank of Russia. When this happened, the US confiscated the foreign holding of the central bank of Russia. This sent a shockwave to the world, if you are an enemy of the state or don’t agree with the US and G7 then the US Treasuries that you hold may be frozen or confiscated. Remember, gold reserves do not carry US counterparty risk thus, a move away from T-bills to gold was put in motion.

High inflation and fiscal dominance are not just a US problem, it is happening in every western country. The aging baby boomers has changed the demographics in the western world and no national government is willing to reform entitlement programs. Thus, high inflation and currency debasement will continue until we have a financial reset which will include a new world order.

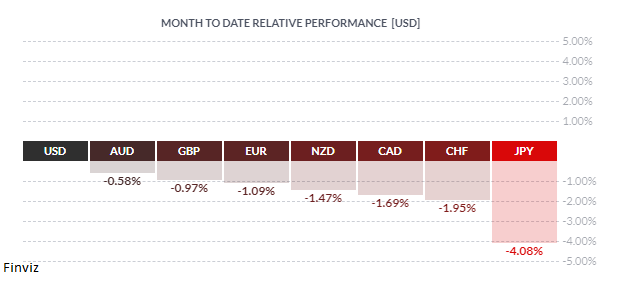

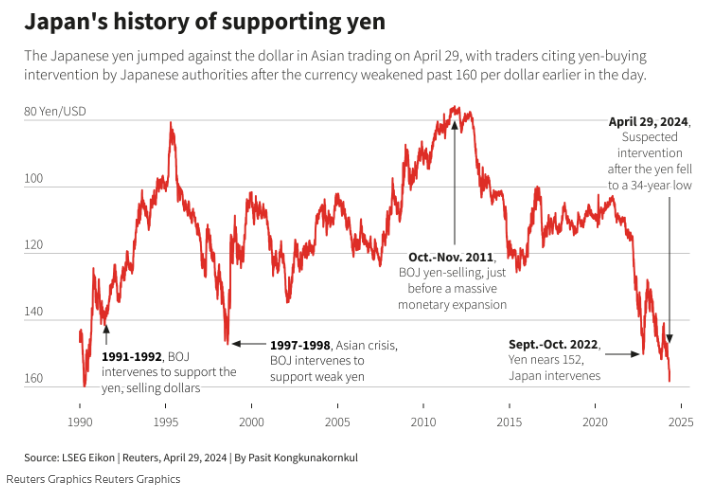

Notice which country has the worst debt-to GDP ratio. This is the primary reason why the Japanese yen is currently under duress. The yen has been so weak that it’s back to where it was in 1990, shortly after Japan’s famous “bubble economy” burst. Remember, the Bank of Japan recently moved monetary policy from negative interest rates to zero. The Bank of Japan does not seem exceptionally concerned about the yen’s weakness and has indicated that easy monetary policy will continue. This puts the onus on the Ministry of Finance, which makes intervention decisions. Officials say that they will take appropriate action if necessary.

Japanese officials could end yen weakness in an instant by raising interest rates. But why don’t they – remember the debt-to-GBP ratio, if they raise interest rates then the Japan’s interest expense on the national debt rises. Thus, more and more of their fiscal budget will go toward paying off the interest on the debt instead of government spending to support the country. As I pointed out before, every western country is in this situation. They all have too much debt and the best they can do is get back to zero interest rates as soon as possible – they just need a crisis (war, pandemic, recession, etc.) to do so.