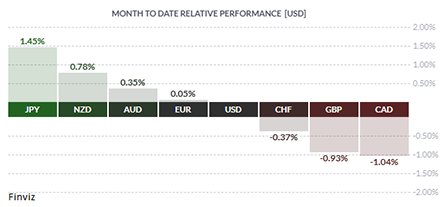

The CAD was the weakest performer in January, pressured by a rate cut from the Bank of Canada and renewed tariff threats from President Trump. In contrast, Japan saw the opposite trend—the Bank of Japan raised interest rates, and the absence of U.S. tariff threats helped the yen strengthen 1.45% against the USD over the month.

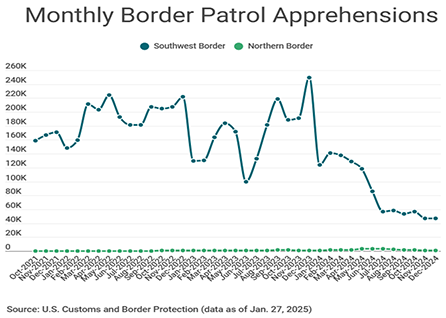

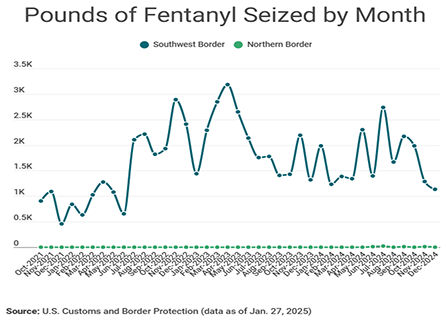

Market sentiment quickly shifted from concerns over China’s DeepSeek AI to uncertainty surrounding tariffs. On Friday, the White House announced that President Trump would impose a 25% tariff on goods from Mexico and Canada and a 10% tariff on Chinese imports. This marks a shift away from the post-COVID emphasis on near-shoring and friend-shoring of supply chains toward onshoring to U.S. soil. While the administration cited concerns over illegal immigration and fentanyl trafficking, the policy shift suggests broader economic and geopolitical motives.

In Canada’s case, U.S. Border Patrol apprehended 23,721 individuals crossing the northern border illegally in 2024—just 1.5% of total nationwide apprehensions. Meanwhile, fentanyl seizures from Canada have accounted for less than 1% of all fentanyl captured by Border Patrol in the last 3 years.

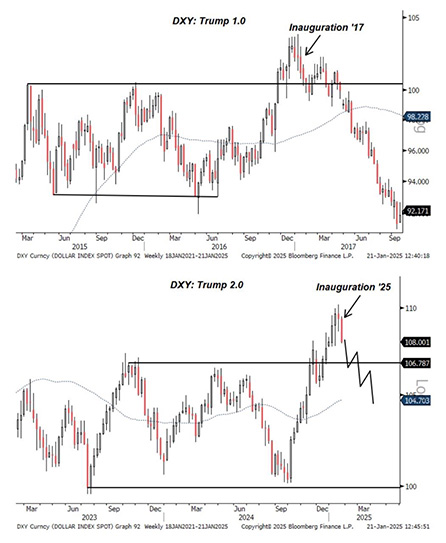

The big conundrum is that Trump wants lower interest rates and a weaker USD, but tariffs could be inflationary. I say “could” for two reasons. First, during Trump’s first term, tariffs did not lead to significant inflation. Second, U.S. companies importing tariffed goods may choose to absorb the extra costs rather than pass them on to consumers. However, if tariffs do drive inflation higher, the Federal Reserve could be discouraged from cutting interest rates, which would, in turn, strengthen the USD.

Above is the U.S. Dollar Index chart, which measures the USD’s value relative to a basket of foreign currencies. Notably, the index peaked just ahead of Trump’s first presidential inauguration. So far in 2025, the same pattern is emerging, but if these tariffs are implemented, they could shift the USD’s trajectory.

As of this writing, it looks like we have ourself a trade war as both Canada and Mexico have ordered retaliatory tariffs. Canada initially ordered tariffs on $155 billion worth of American goods starting February 4. A second list of goods was to be released soon on $85 billion worth of goods. Mexico has so far said only that it will impose retaliatory tariffs, without mentioning any rate or products. No word from China yet.

The *Wall Street Journal* didn’t hold back in its opinion piece. No one wins a trade war, so what’s the endgame? If Trump extends tariffs to other countries, such as Europe and Japan, I think the answer becomes clearer.

This is purely my speculation, but tariffs could be a temporary negotiating tool with a larger objective in mind. The ultimate goal may be to push for a multilateral agreement to weaken the USD—essentially another Plaza Accord, or what I dubbed the “Mar-a-Lago Accord” in last month’s newsletter.

With Fed Chairman Powell resisting Trump’s calls for rate cuts, tariffs might serve as a way to create economic uncertainty and pressure equity markets. In doing so, Trump could force the Fed’s hand into cutting rates and launching massive QE stimulus. Again, just my speculation.

I’ll leave you with Sunday’s opening CADUSD rate. The CAD is on course for its biggest daily fall against the USD since the early days of the covid pandemic – its going to be a long Monday