The Market Dispatch, Feb 05, 2024

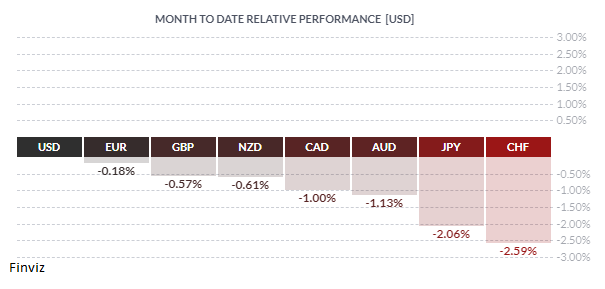

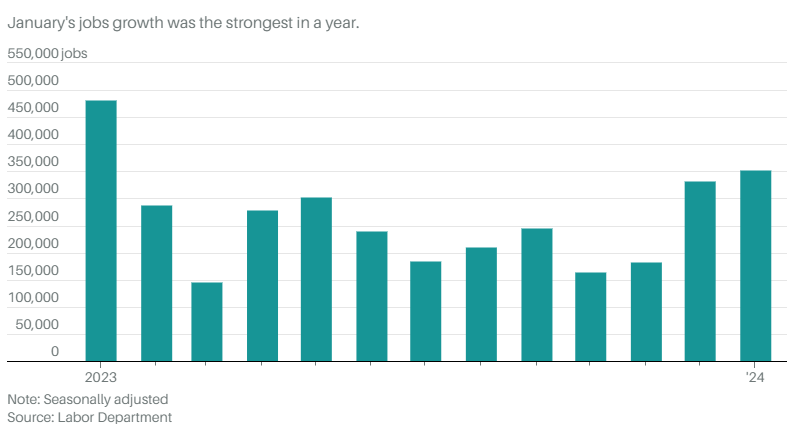

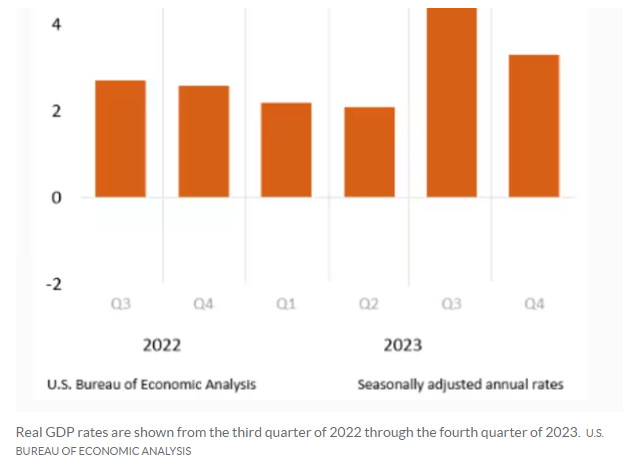

What a difference a month makes. The USD is up against every major currency this month after being down against ever single currency last month. Last month, the currency narrative changed from “higher for longer” to “cuts, cuts, cuts”. It did seem that the market ran too far and too hard with that narrative causing markets to price in 6 to 7 rate cuts for 2024 while the Fed’s dot plot only signalling 3 cuts. Thus, in January, I did expect commentary from Fed policymakers to push back on that, which they did. What I didn’t expect, was the blockbuster jobs data on Friday – payrolls rose by a much stronger-than-expected 353k in January, the unemployment rate held steady at 3.7%, payroll employment was revised up by a combined 126k over the last 2 months, and average hourly earnings grew by 0.6%. This came on the back of an upward revision of the Atlanta Fed’s GDPNow forecasting model of 4.2%, up from a 3% estimate given a week earlier. The narrative just shifted from a soft-landing recession to no landing/reacceleration. The growth divergence between the US economy and the rest of the world is back, as the US economy continues to defy expectations.

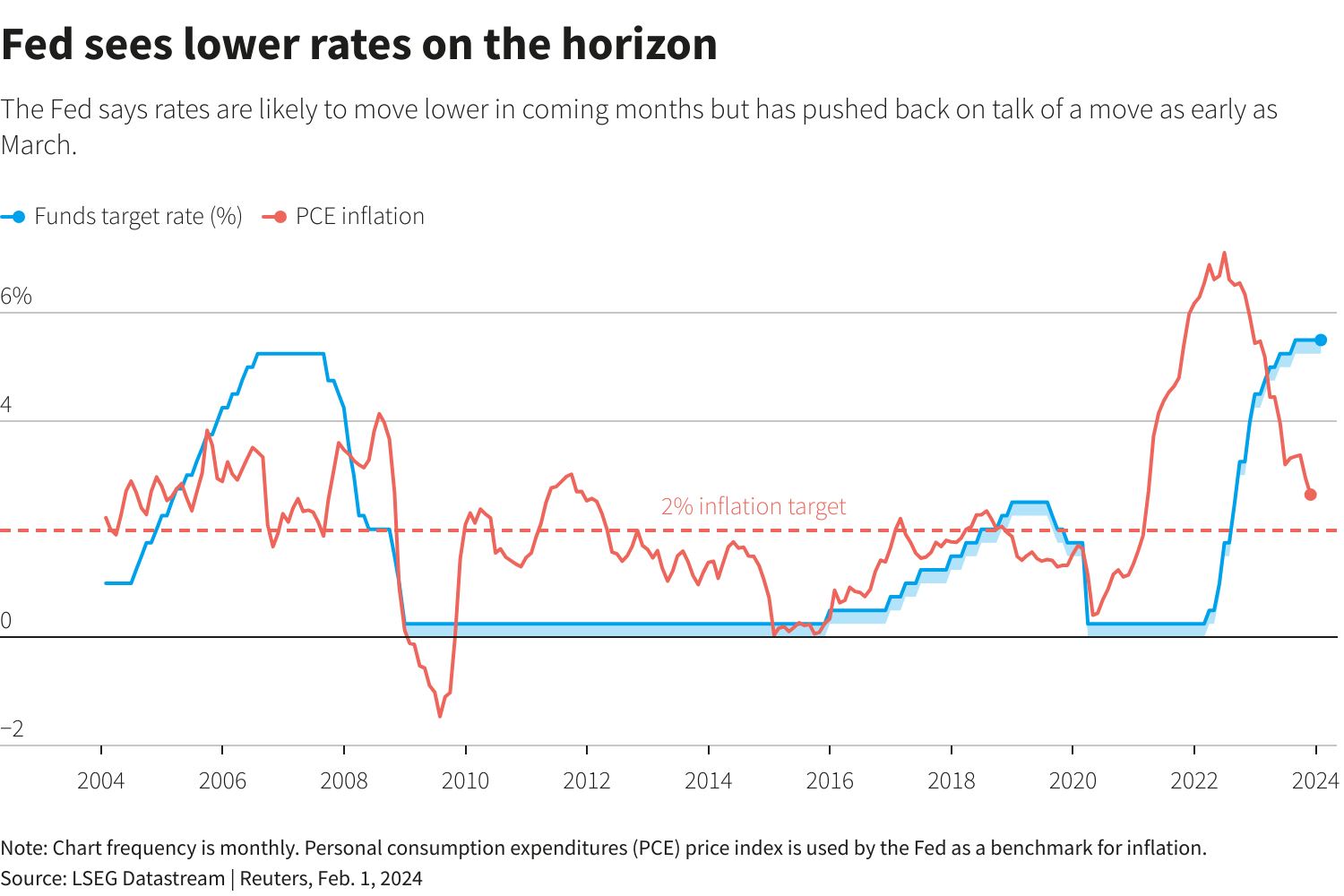

The FOMC meeting last Wednesday also helped to reel back the lofty expectations of multiple rate cuts. The Fed acknowledged that growth was solid, and that inflation was showing signs of easing over the past year, but it still remains elevated. On the positive side, references to future rate hikes were notably toned down, however it expressed a cautious stance on imminent rate cuts. In fact, Chair Powell was more forthright when he stated that it is “unlikely” that the committee will be sufficiently confident by March to implement rate cuts.

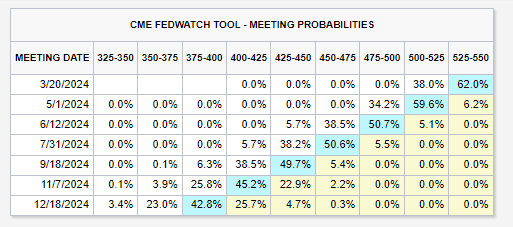

The combination of the FOMC meeting, Powell’s remarks, outstanding jobs data, and upward revised GDP growth were able to downshift the rate cut expectations for the year. On January 3rd the market was pricing in a 64.7% chance of a rate cut in March. It is now slipped to 38%.

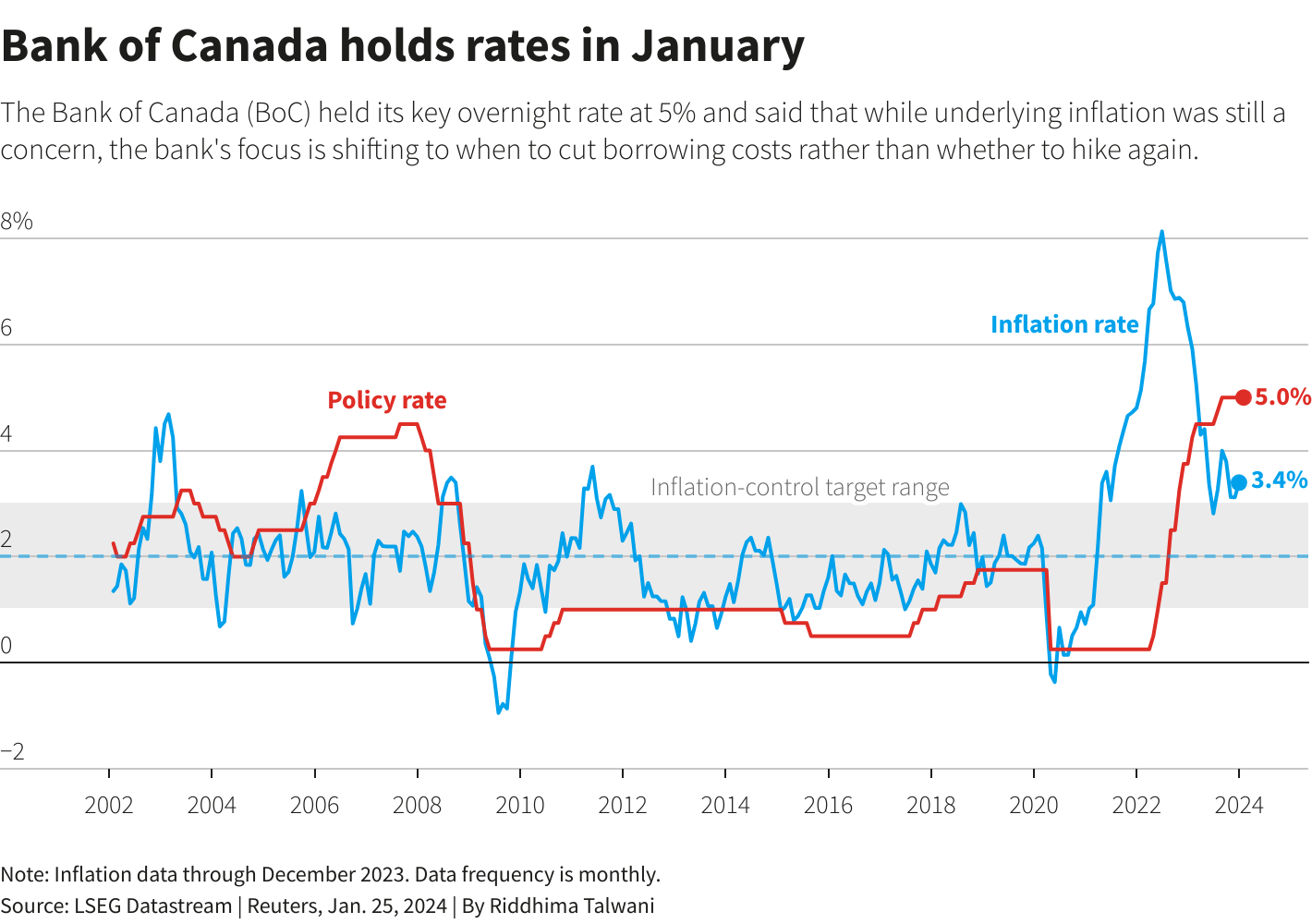

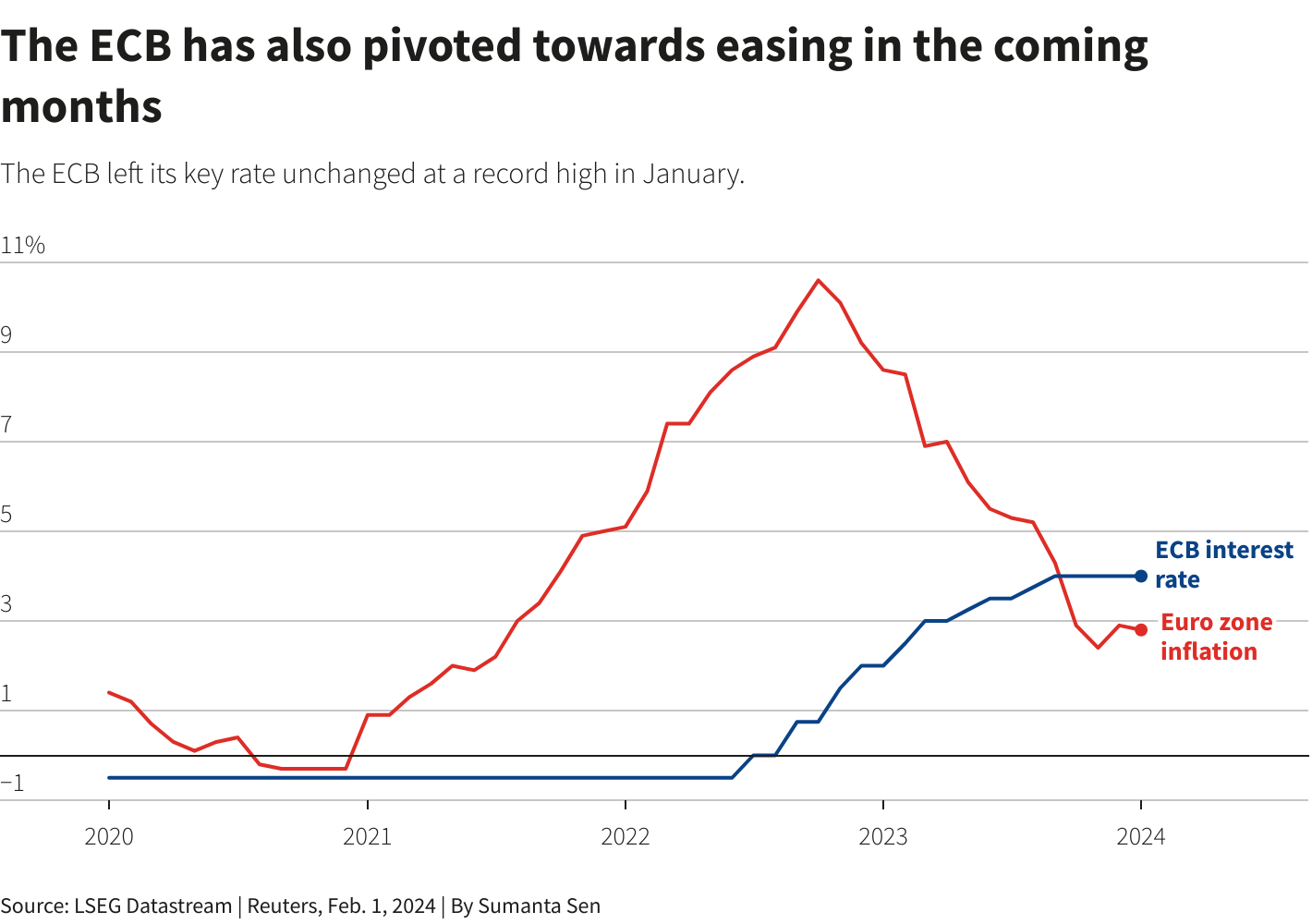

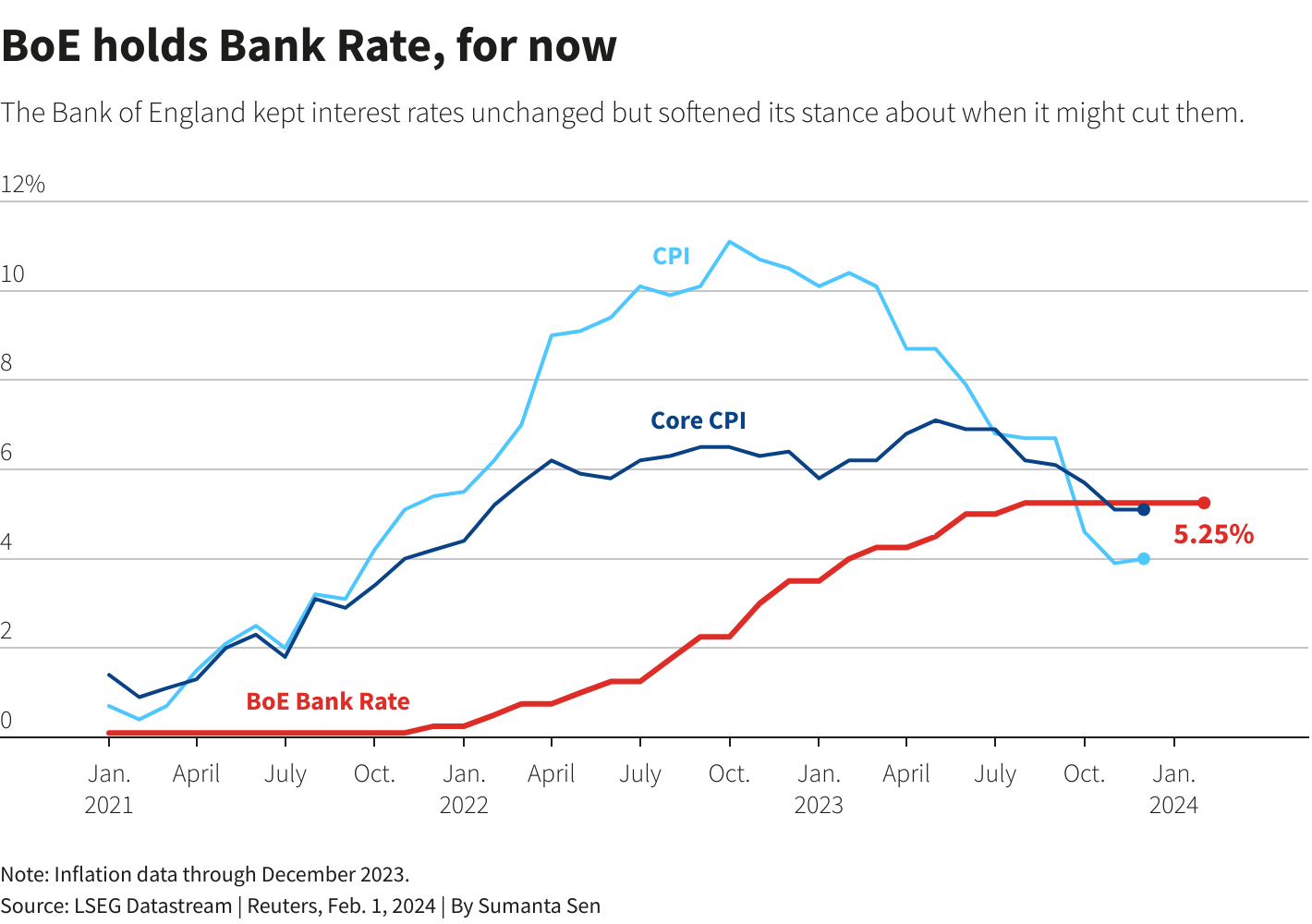

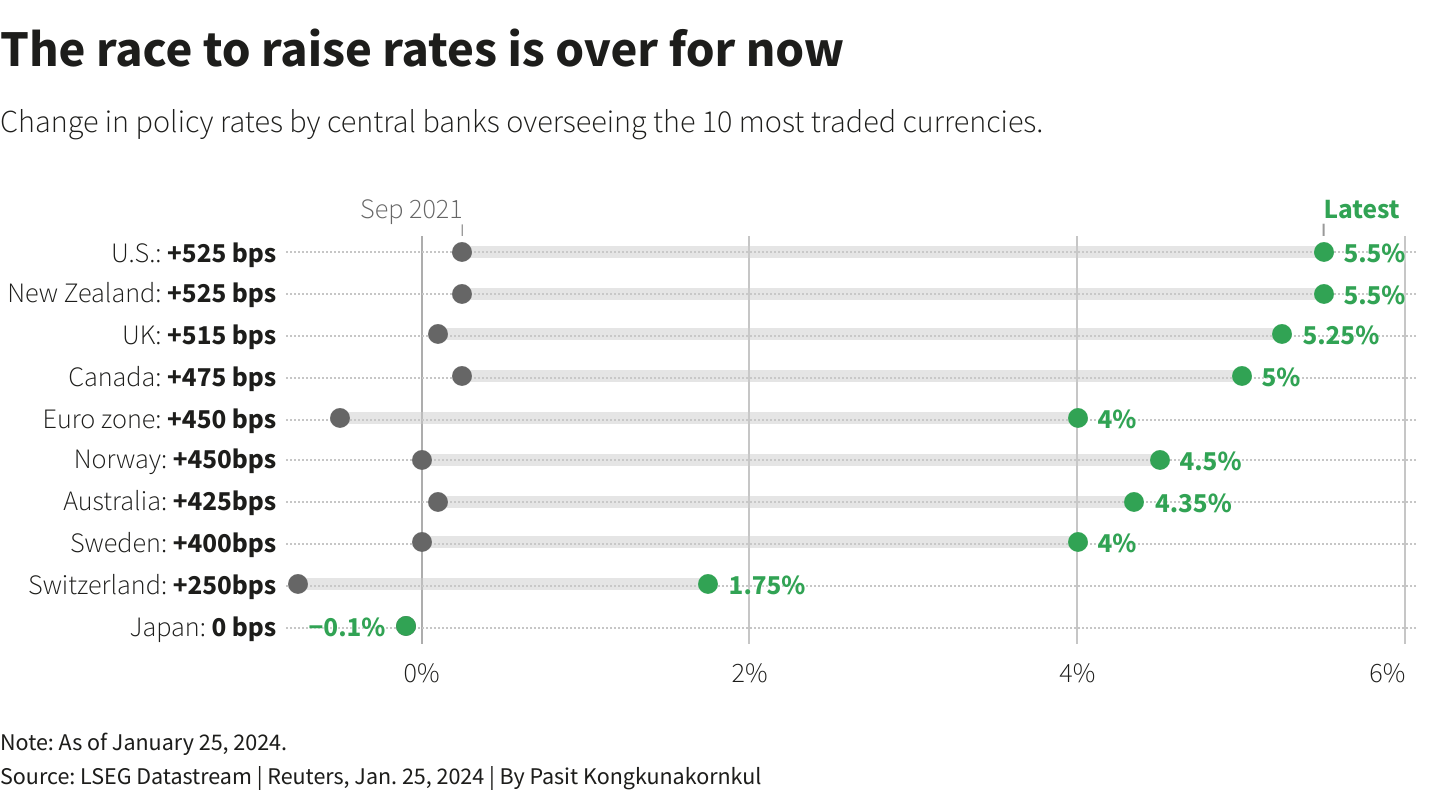

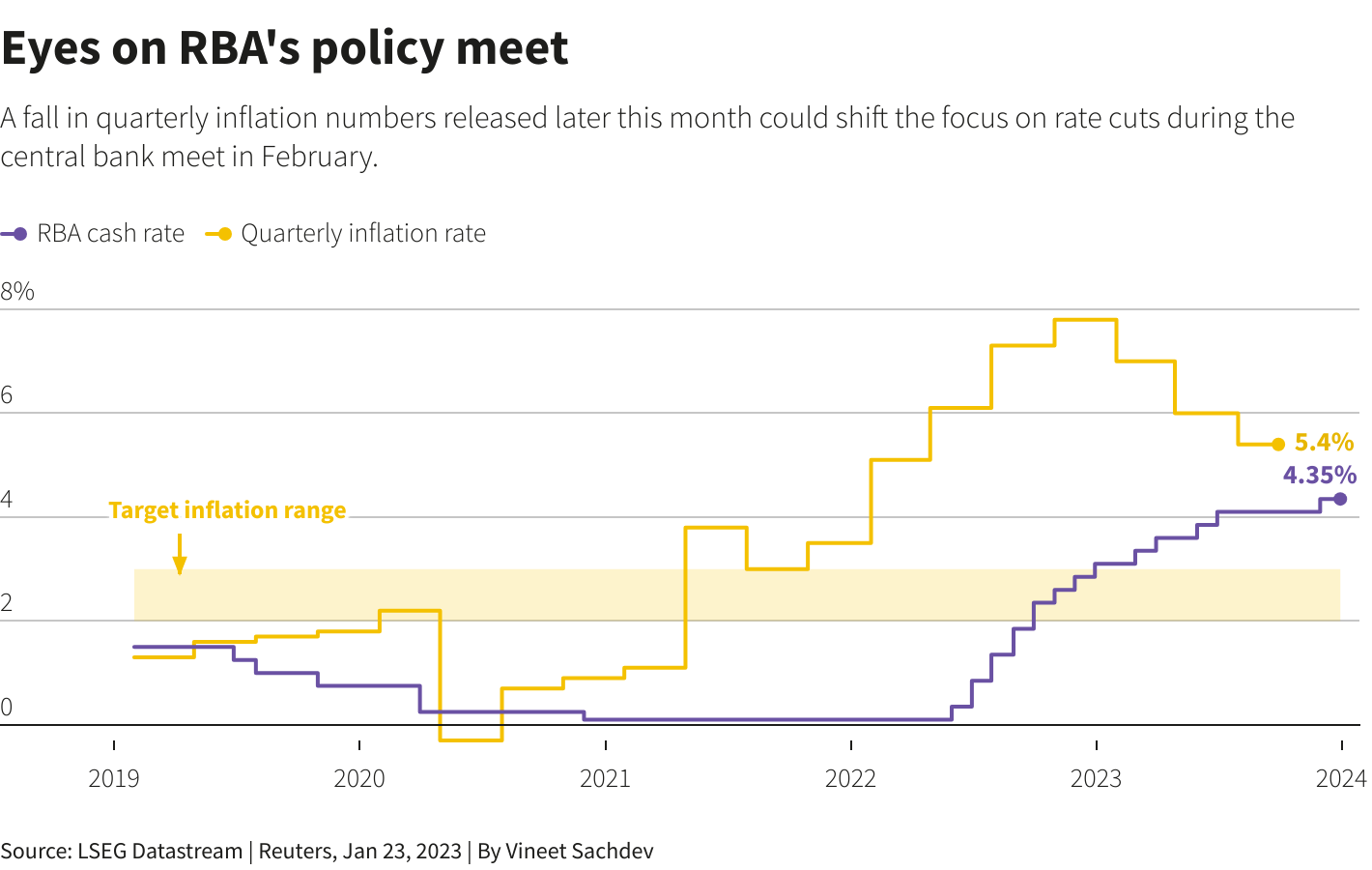

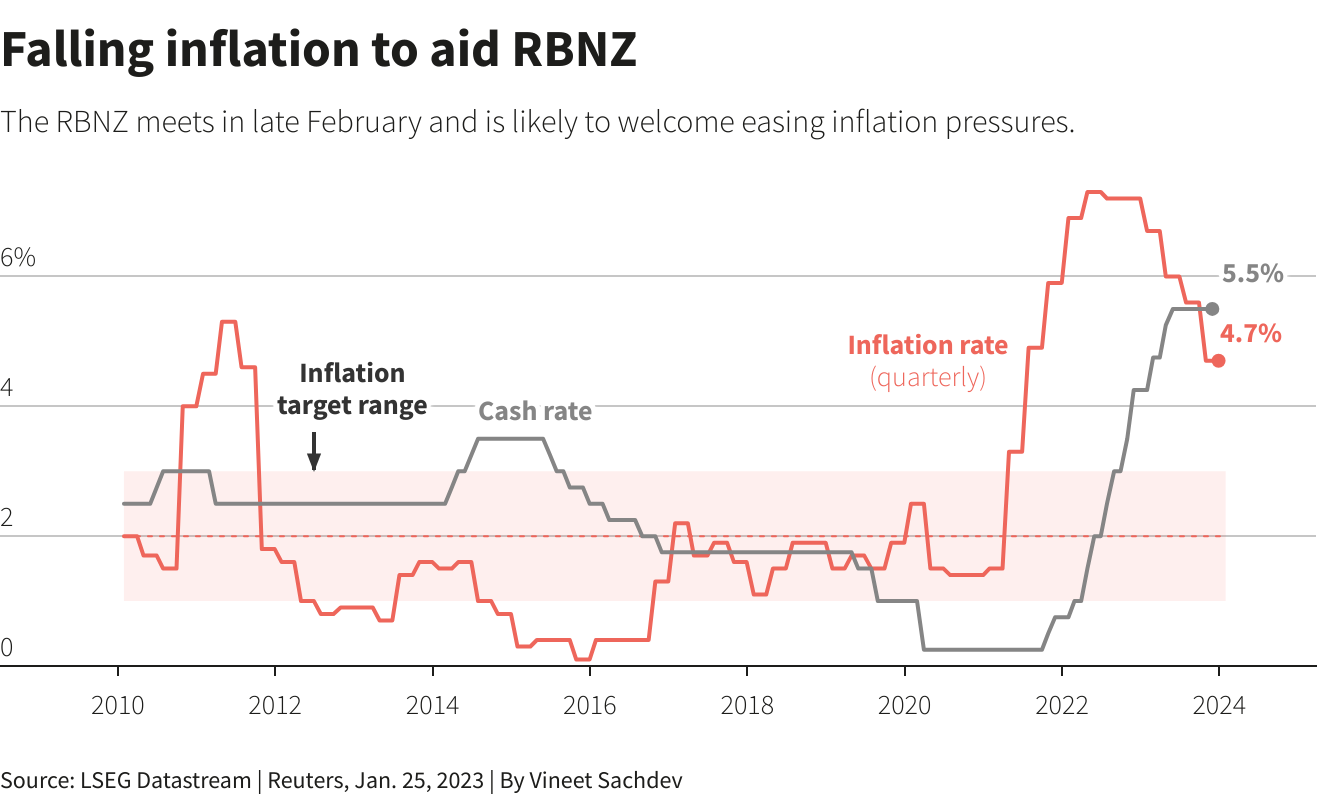

Regardless of central bank jawboning, the following is how the market sees rate cuts unfolding globally: