The Market Dispatch, April 2, 2024

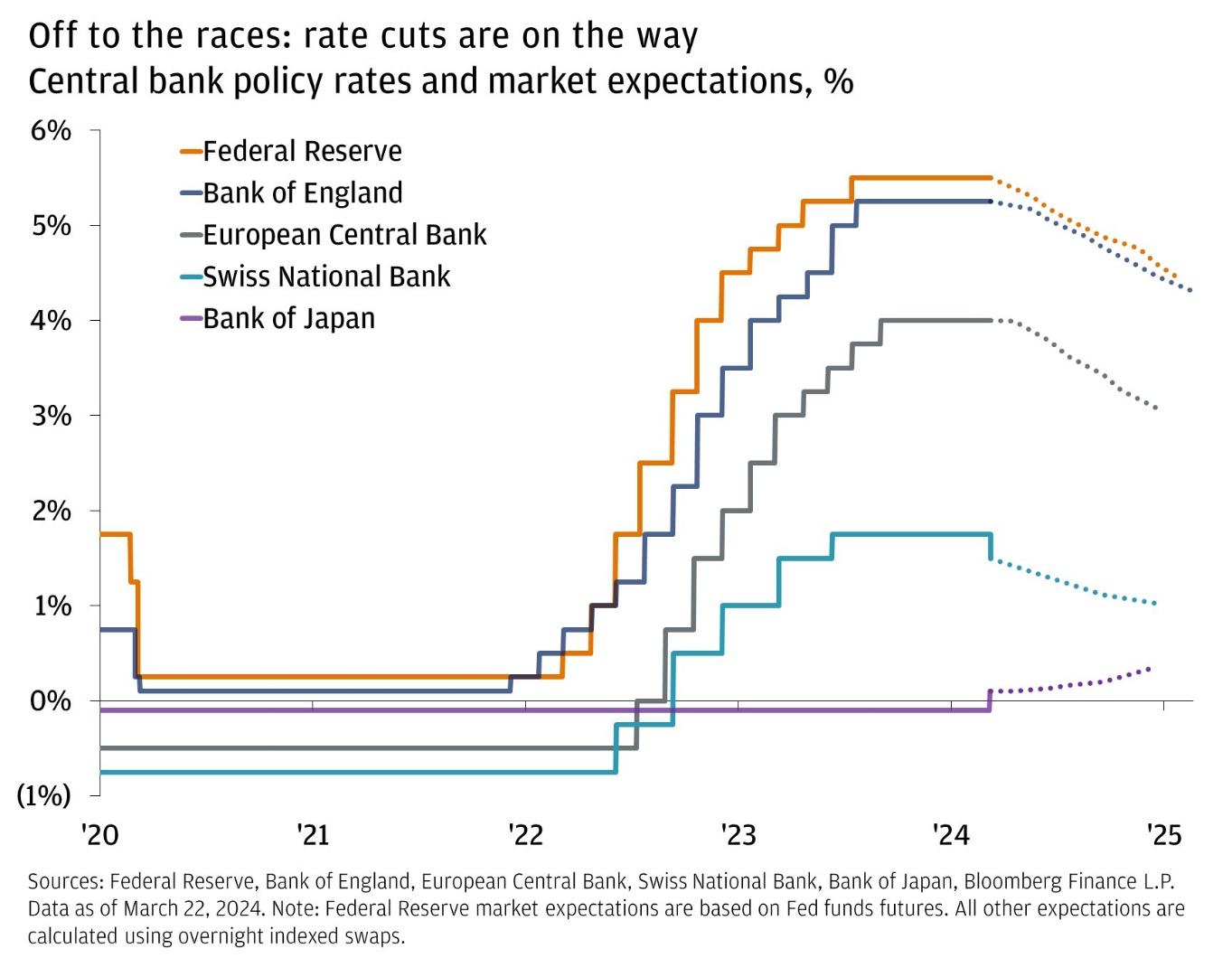

The big surprise in March was a rate cut of 25bps to 1.5% from the Swiss National Bank. The SNB’s decision, its first rate cut in nine years, made it the first major central bank to dial back tighter monetary policy aimed at tackling inflation. The SNB stole the limelight from the Bank of Japan, which ended eight years of negative interest rates with its first interest rate hike in 17 years. The BOJ cut its short-term policy rate from -0.1% to between zero and 0.1% and it also ended the yield curve control on the Japan 10-year government bond. The BoJ started its negative interest rate policy in 2016 to prevent a stronger yen from damaging the export-oriented economy, and to fight deflation, though after significant wage increases at large companies, the bank decided to end the policy. Interestingly, the last two central banks with negative interest rate policies decided to end them within a week of each other, just as the other major central banks embark on new rate cutting cycles.

The U.S. Federal Reserve also held a policy meeting in March, and they decided to keep key rates unchanged at 5.25-5.50% (a 23-year high) for 5th straight meeting. It stated that it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward two per cent.” FOMC members also left the median projection for interest rates at end-2024 at the midpoint between 4.50 and 4.75. This means they still expect 75 bps of cuts before the end of the year. I would call this a hawkish statement.

During the post FOMC press conference, Chaiman Powell, seemed to throw in the towel and tilt dovish. Here are some of the things that he said:

- We tend to see a little bit stronger inflation in the first half of the year.

- My instinct is rates won’t go back down to very low levels we saw before.

- It is still likely in most people’s view that we will have rate cuts this year but depends on data.

- If there were a significant weakening in labor market, that would be a reason to start rate cuts.

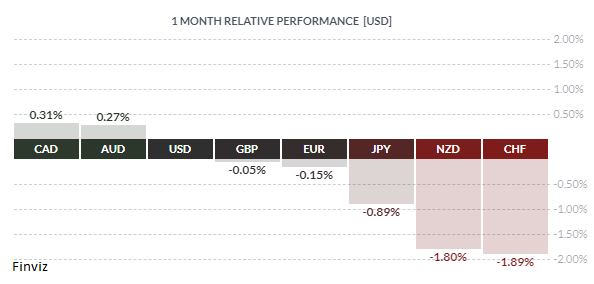

My take is that Powell wants to cut rates. He could have easily found data that supported staying on hold much longer or indicating fewer or no cuts this year. The fact that he didn’t lean on the hawkish data, even with plenty of data to back his case, gives me the impression that the Fed will cut at its next meeting in June. Having said that, you wouldn’t get that impression from the performance of the USD. The USD is still firm and showing no signs of relenting.

t would seam that the current driver of USD strength is not interest rate policy but rather economic growth divergence. The American economy is outpacing every other major economy and that is putting in a firm bid underneath the USD. The Dollar Index (a proxy of the US versus its trade partners) looks like it wants to take a run at the October-November highs between 106-107 (chart above) in the coming weeks. The only thing that would undo this would be but weaker economic data as Q2 unfolds and or an actual rate cut by the Fed.

The other notable development in March was the continued inaction by the China’s government to address its economic situation. There was no specific meaningful stimulus announced at the conclusion of the Chinese government’s annual plenary sessions of the National People’s Congress last month. There continues to be pledges of supportive talk but no specific actions. Last week, China’s Xi Jinping met with a group of 18 American business executives in Beijing in an attempt to boost overseas investment in the country amid ongoing geopolitical and trade tensions between China and the US. China needs to rollout its own version of QE but is reluctant to do so ahead of Fed easing.

Meanwhile in Europe, both the euro and sterling are struggling. Economic and interest rate divergence between the US and the eurozone helped drive the euro to new lows in March. Swap markets are more convinced that the ECB will cut rates in June than the Fed and they are pricing in nearly 4 ECB rate cuts this year compared to barely 3 cuts in the US.

In the UK, the GBP went into March with a head of steam but quickly turned bearish as the Bank of England seemed less hawkish. The swaps market boosted the chances of a June rat hike to around 70% from closer to 40% at the end of February.

In Canada, the CAD has its best month of the year, rising 0.25% against the USD after falling around 2.5% in the previous two months. The swaps market is pricing in a 66% chance that the Bank of Canada will deliver its first cut June. Also, it is pricing in only 3 cuts this year compared to 4 earlier in the year.

As I stated in the January letter, a dovish Fed and increase government spending in an election year will undermine the USD. We are not there yet but its coming – you only have to look at the relentless rise in gold and bitcoin to see that.