Market Place Dispatch

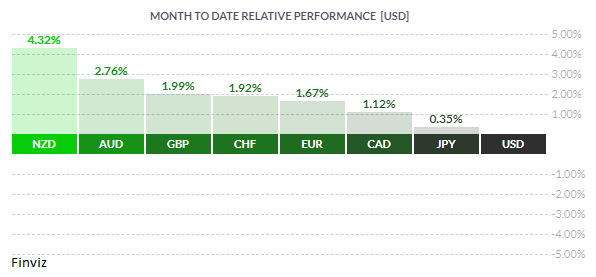

Although the USD was down against all the majors in May, it is a little deceiving as the month was a tale of two halves. The first part of the month was marred by weak real economic data which weighed on the USD. In the second part of the month, hawkish talk by Fed members, more hawkish than expected FOMC minutes, and some better-than-expected economic data helped to arrest the downside in the USD and helped to firm it up going into next month. In the early part of the month, markets had two quarter-point Fed cuts priced in for this year with the first one slated for September. By the end of the month, the markets had repriced to one cut and almost a 50% chance of a second cut.

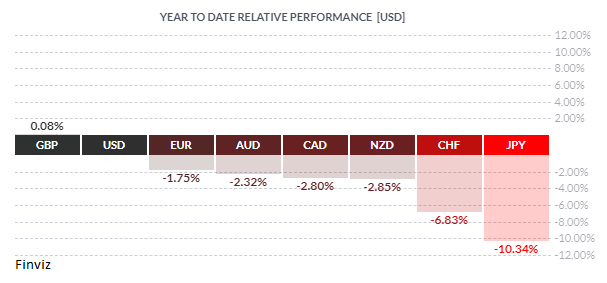

When we zoom out and look at the year-to-date performance of the majors, we see that the USD is still dominating. The GBP is slightly higher on the year helped by strong Q1 growth, the strongest since the end of 2021, and the pricing out of interest rate cuts due to hot inflation figures.

So, while the USD has been the best performing currency for the first part of the year, it did underperform for the month of May. This begs the question, is the USD about to roll over here as we kick off the second half of 2024. We start June with 1 and possibly 2 rate cuts by major central banks in the first week. The first potential candidate on the docket is the Bank of Canada on Wednesday followed by the European Central Bank on Thursday.

The Canadian economy expanded by 1.7% annualized rate it Q1 24, which was a little slower than the 2.2% that was expected. Also, the pace of growth (currently around 1% in Q2) continues to underwhelm. On the inflation front, the BOC’s core measures of CPI fell into the central bank’s target range in its latest reading. This has caused the markets to reprise a rate cut this week to nearly 80%, up from around 50% at the end of April. According to 16 out of 26 of economists surveyed by Bloomberg expect the BOC could cut by a quarter point next week, to 4.75% from 5%. Even if the BOC does not cut and decides to wait another month, it would be a negative for the CAD as it would be interpreted as a dovish hold as the central bank prepares the market for a cut soon.

An ECB interest rate cut on Thursday appears certain, according to all 82 economists polled by Reuters, a majority of whom predicted two further reductions in September and December. Having said that, swaps markets only have 2 cuts factored in for 2024. The pace of cuts will really depend on wage inflation, which has picked up lately.

On the surface, these 2 rate cuts would be a negative for each currency versus the USD. However, it will really depend on how the cuts are framed by each central bank. If the two banks signal that more cuts are coming, then the two currencies will initial weaken on the headline but later strengthen if the banks don’t signal further cuts – a hawkish cut. If that is the case, then the USD may indeed start to roll over.

FYI, gold has overtaken the euro in global international reserves held by central banks.