Signed, Sealed, To Be Delivered

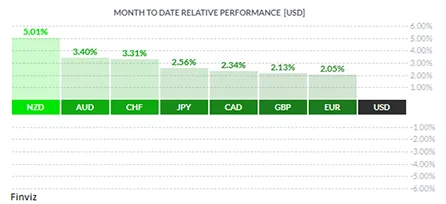

The U.S. dollar faced significant pressure in August, declining across the board. The magnitude of these moves suggests a shift in market sentiment. As shown in the daily chart of the U.S. dollar index above, the only reprieve came from a brief 3-day countertrend rally at the end of the month, likely driven by month-end flows. This shift coincides with Federal Reserve Chairman Jerome Powell’s remarks on August 23 at the Jackson Hole Economic Symposium, where he signaled that the FOMC would begin its easing cycle next month. Powell’s key points included:

- THE TIME HAS COME FOR POLICY TO ADJUST’ – BBG

- WE DON’T SEEK OR WELCOME FURTHER LABOR MARKET COOLING

- MY CONFIDENCE HAS GROWN THAT INFLATION IS ON PATH TO 2%

- COOLING IN LABOR MARKET CONDITIONS IS ‘UNMISTAKABLE’

- LABOR MARKET IS NOW LESS TIGHT THAN BEFORE PANDEMIC

- LABOR MARKET IS NOW LESS TIGHT THAN BEFORE PANDEMIC

- INFLATION RISKS HAVE DIMINISHED, LABOR RISKS INCREASED

- TIMING, PACE OF CUTS TO DEPEND ON DATA, OUTLOOK, RISKS

- WILL DO EVERYTHING WE CAN TO SUPPORT STRONG JOB MARKET

- CURRENT RATE LEVEL GIVES AMPLE ROOM TO RESPOND TO RISKS.

This so-called “Powell Pivot” is now fully realized. Powell’s dovish tone is striking, especially considering that two years ago, from the same stage, he indicated that the Fed would tolerate a recession to rein in inflation.

The Fed's upcoming monetary policy decision

The Fed’s upcoming monetary policy decision is just one of seven major central bank meetings scheduled for September:

| Central Bank | Meeting Date | Current Rate | Change |

| Bank of Canada | September 4 | 4.50% | 100% probability of a cut |

| European Central Bank | September 12 | 4.25% | 100% probability of a cut |

| US Federal Reserve | September 18 | 5.25 – 5.50% | 100% probability of a cut |

| Bank of England | September 19 | 5.00% | 77% probability of a hold |

| Bank of Japan | September 20 | 0.25% | 96% probability of a hold |

| Reserve Bank of Australia | September 24 | 4.35% | 94% probability of a hold |

| Swiss National Bank | September 26 | 1.25% | 100% probability of a cut |

The monthly chart below illustrates that the U.S. dollar index peaked in September 2022, reaching levels not seen in 20 years. Since December 2022, it has fluctuated between 107.05 and 99.20. I anticipate that the index will break this range to the downside, potentially testing support around the 98 level. However, markets rarely move in a straight line. After the steep declines in July and August, technical indicators are oversold, suggesting a possible countertrend rally before the downtrend resumes.

Meanwhile, south of the border, market expectations remain strong that the Bank of Canada will implement rate cuts at each of its three remaining meetings this year (September 4, October 23, and December 11). The swaps market is pricing in at least two more cuts in the first half of 2025, with the probability of a third cut in H1 2025 now around 40%. This has been largely factored in by the market.

During the market turmoil, surrounded around the Yen carry trade, that climaxed in early August, the CAD hit a new low for the year around 1.3945. However, it staged a strong recovery in the weeks that followed, reaching its highest level since March by the end of the month near 1.3440. We expect that corrective forces could push the greenback to test the 1.3600 area, where former support might now act as resistance.